BlackRock, Vanguard, State Street: Architects of the New World Order?

The Big Three's Unprecedented Control over World Economies and Population.

Last week, I wrote about how the 'Swarm' controls the entire world population through a select elite of 10,000, comprising individuals, corporations, senators, government agencies, and financial institutions. Above them all, sit BlackRock, Vanguard, and State Street, who collectively exert control not only over our energy, food supply, and healthcare but also over virtually every aspect of our lives, accomplishing this by dominating the world of finance. Their power lies not in creating more value but in controlling the source of money. If you follow the money, you will learn that everything you once believed about money is simply untrue.

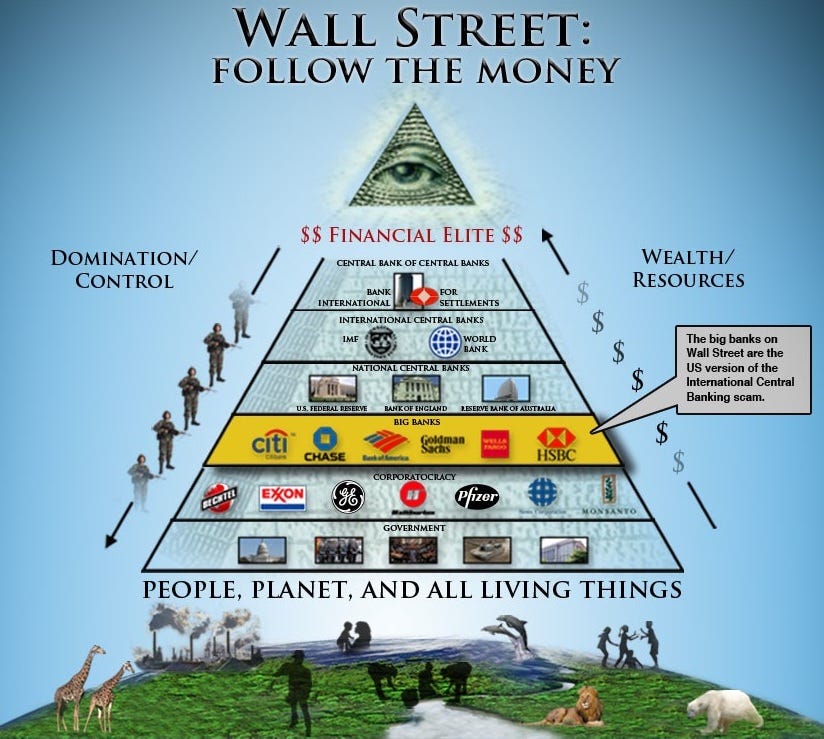

To illustrate this, at the bottom are the 8 billion people who are going about their lives to survive. Above them is the government, a group of people who are granted a monopoly on force and use it to tax and control us, regardless of whether we agree.

But who controls them? At the next level are the corporations. Many would argue that it is now corporations, rather than nation-states, that govern the world. They refer to it as a corporatocracy. To obtain the world's resources and dominate the markets, this corporatocracy must have access to inexpensive capital. The large corporations secure loans at preferential rates from major banks, implying that those who oversee the major banks, the financial elite, ultimately govern the corporations.

Breaking down the hierarchy:

Financial Elite: This global financial elite, represented by influential figures like the Rockefellers, Rothschilds, and Morgans, convene clandestine meetings within exclusive groups such as the Council on Foreign Relations. Their decisions shape worldwide economic policies, consolidating wealth and control on a grand scale.

Bank for International Settlements (BIS): Situated in Basel, Switzerland, the BIS functions as the central bank for central banks. Dominated by financial magnates, predominantly from the United States, England, Germany, Switzerland, Italy, and Japan, it operates discreetly and escapes the oversight of national governments. Despite its low profile, the BIS wields substantial authority in the global financial realm by regulating reserve requirements, affecting the money banks must hold in reserve.

International Central Banks: Central bankers strategically leverage institutions like the World Bank and the International Monetary Fund (IMF), exploiting the resources of countries they lend to while often pushing them into financial turmoil. For instance, every dollar contributed by the United States to these institutions results in more than double that amount in contracts for U.S. Corporations such as Halliburton, Exxon Mobil, and Bechtel, all controlled by the economic elite.

National Central Banks: Virtually all nations maintain a central bank, where commercial banks hold memberships. Central banks wield the authority to set interest rates and determine the money supply. They also extend loans to governments, securing a higher position in this hierarchy.

Big Banks: Prominent financial institutions provide corporations with loans at preferential rates, enabling their business endeavors. This positioning elevates banks above corporations and the general populace, as funding is the lifeblood for corporate projects.

Corporatocracy: Corporations wield considerable influence by financing political campaigns and exerting their power through lobbying. In today's landscape, some corporations surpass entire national economies, thereby overshadowing the government.

Government: Governments primarily rely on taxpayer funds, granting them a position superior to the people. If the government requires additional capital, it must turn to a Central Bank for borrowing.

People, The Planet, and All Living Things: At the foundation of this hierarchy lies the majority of the world's population and all other forms of life. Disturbingly, by 2010, one in seven people on Earth faced food scarcity, and ecosystems were in a state of distress.

The BlackRock Story

BlackRock, founded in 1988 by Larry Fink, has grown into the world's largest asset manager, overseeing trillions of dollars in assets. The firm's journey to dominance was punctuated by strategic acquisitions, including the purchase of Barclays Global Investors in 2009. This move solidified BlackRock's position as a leader in both active and passive investment strategies

The Vanguard Story

Vanguard, founded by John C. Bogle in 1975, revolutionized the investment industry with its innovative approach to passive investing. Bogle's creation of the first index mutual fund, the Vanguard 500 Index Fund, laid the foundation for the company's future success. The philosophy was simple but groundbreaking: provide investors with low-cost, diversified portfolios that mirror market indexes. Vanguard's emphasis on low fees has been a game-changer, allowing individual investors to access the market at a fraction of the cost charged by traditional active fund managers.

The State Street Story

State Street Corporation, founded in 1792, is one of the oldest financial institutions in the United States. While it may not have the same household name recognition as Vanguard or BlackRock, it plays a critical role in the global financial system. State Street is a leader in custodial banking, serving as a trusted guardian of institutional assets.

The Big Three

"BlackRock and Vanguard stand as two of the paramount passive fund asset management conglomerates, constituting part of the prestigious Big Three. The third player, State Street, finds itself in a unique position, owned by BlackRock, whose most substantial shareholder happens to be Vanguard. It becomes increasingly evident that all paths in the financial world converge toward the dominion of BlackRock.

The collective management of assets, a staggering $20 trillion, wields a power eclipsing over half the total value of all shares within the S&P 500, a colossal sum nearing $38 trillion. This monetary influence surpasses the entire Gross Domestic Product (GDP) of all nations, except China and the United States.

The assets under management (AUM) under BlackRock and Vanguard's purview are astronomical, standing at $8.6 and $8.1 trillion, respectively. In total, they exert their influence over a staggering 1,600 U.S. companies, as reported by Reuters in 2022.

Navigating the Global Financial Markets

At the heart of BlackRock's dominance lies its clandestine weapon, a sophisticated trading algorithm known as Aladdin, or the Asset, Liability, Debt, and Derivative Investment Network. Aladdin, a marvel of computational prowess, has been orchestrating global markets for decades.

With the ability to execute an astonishing average of 250,000 trades daily, Aladdin commands a formidable arsenal, managing a staggering $21.6 trillion in assets. Its reach extends across all corners of the financial landscape, guiding the actions of the Federal Reserve and nearly every major U.S. financial institution. Aladdin's dominion extends over half of all Exchange-Traded Funds (ETFs), a considerable 17% of the bond market, and an influential 10% of the stock market. It compiles a vast array of data on markets, companies, and assets, harnessing machine learning to inform its trading decisions.

These financial titans extend their reach to other corporate giants encompassing a multitude of brand names, including Unilever, Mondelez, Nestlé, General Mills, The Hershey Company, and Kraft Heinz, among others.

The Tech Industry and Its Puppeteers In the realm of technology, BlackRock, Vanguard, and State Street exert their dominance, laying claim to a substantial portion of stocks in Alphabet, Apple, Microsoft, IBM, Facebook, AT&T, and numerous others, cementing their status as first-mover champions.

The Energy Sector and Its Financial Overlords BlackRock has funneled a staggering $170 billion into U.S. public energy firms in 2021 alone, reserving $85 billion for investments exclusively in coal companies. Furthermore, BlackRock, State Street, and Vanguard collectively hold a substantial $46 billion in debt and equity within oil companies currently operating within the Amazon rainforest. Their presence extends to a multitude of energy giants, including ConocoPhillips, Occidental Petroleum, Chevron Corporation, and General Electric, among others, amassing a nearly $260 billion stake in fossil fuel enterprises worldwide.

BlackRock holds at least $6 billion in debt and $24.2 billion in equities in oil companies currently operating in the Amazon rainforest, including $1.5 billion in combined debt and equity in the companies investigated in the report’s case studies.

Vanguard holds over $2.6 billion in debt and $9.6 billion in equities in oil companies currently operating in the Amazon rainforest, including over $503 million in combined debt and equity in companies investigated in the report’s case studies.

State Street holds $460 million in debt and $2.7 billion in equities in oil companies currently operating in the Amazon rainforest, including $19.5 million in combined debt and equity in companies investigated in the report’s case studies.

The Guardian's investigation has uncovered that the world's three largest asset managers have collectively amassed a fossil fuel investment portfolio worth $300 billion, sourced from individuals' personal savings and pension contributions. Not only that but these three have opposed over 80% of climate-related shareholder motions at fossil fuel companies between 2015-2019.

The Pharmaceutical and Healthcare Domain Within the pharmaceutical and healthcare sector, the Vanguard Group commands the lion's share of Johnson & Johnson with an 8.89% ownership, as well as substantial stakes in Merck & Co. (8.95%), AbbVie (8.97%), CVS Health (10%), UnitedHealth Group (9%), Sun Pharma, and GlaxoSmithKline. BlackRock, as the second-largest shareholder, wields significant influence in these corporations and many others.

In the realm of digital media, Vanguard and BlackRock wield unparalleled influence over the flow of bipartisan information. These two giants reign as the top shareholders in media conglomerates like Time Warner, Comcast, Disney, and News Corp, collectively controlling over 90% of the U.S. media landscape. In a remarkable consolidation of power, they commandeer significant stakes in Fox, CBS, Comcast (parent company of NBC, MSNBC, and CNBC), CNN, Disney, and numerous subsidiaries, both domestically and abroad.

Their media empire extends further, encompassing entities like Sonoma, the parent company of major Dutch commercial channels, as well as international media outlets such as VTM. They also lay claim to Mediahuis, one of Europe's largest media conglomerates, operating alongside the German behemoth, Bertelsmann, one of the world's nine largest media firms. Bertelsmann's vast portfolio encompasses 45 television stations, 32 radio stations across 11 countries, and co-ownership of the world's largest book publisher, Penguin Random House.

Delving into the travel industry, the Vanguard-BlackRock alliance commands significant ownership in Expedia Group, Booking Holdings, American Express, Boeing, Airbnb, TripAdvisor, and various other prominent players.

Beyond financial dominion, it's worth noting that as of 2021, BlackRock boasts at least three of its executives occupying influential positions in President Joe Biden's cabinet. Brian Deese, a BlackRock luminary, served as the Head of the National Economic Council, while Adewale Adeyemo, formerly chief of staff to BlackRock's CEO, holds a key role at the Treasury Department. This intersection between BlackRock and the corridors of political power raises compelling questions about the nature of their involvement in shaping economic policy.

Both BlackRock and Vanguard have etched their legacies as voracious acquirers, absorbing numerous competitors over the years. BlackRock's acquisition spree includes 21 organizations to date, with notable deals such as the billion-dollar purchase of Aperio in 2020 and the $1.3 billion acquisition of eFront in 2019. Their most prominent feat was the acquisition of Barclays Global Investors in 2009, which encompassed Barclays' iShares ETF business. This aggressive expansion also extended to the acquisition of Merrill Lynch Investment Managers.

In the realm of non-governmental organizations (NGOs), the Gates Foundation emerges as a pivotal figure, notably as the largest benefactor of the World Health Organization (WHO) following the withdrawal of U.S. financial support in 2020. The Gates Foundation collaborates closely with major pharmaceutical entities, including Pfizer, AstraZeneca, Johnson & Johnson, and Bayer, to name a few. It's illuminating to realize that the very entities discussed here are intricately linked with the largest shareholders, notably Vanguard, BlackRock, and State Street Corp. Remarkably, even Bill Gates assumes a role on the boards of these influential groups.

This intricate web of interconnections serves to construct a bridge between corporations, politicians, and the media, strategically minimizing corporate tax liabilities by redirecting revenues toward nonprofit organizations. In this complex landscape, the veil of conflicts of interest becomes increasingly opaque.

The most pressing issue is for us to recognize the problem. The growing influence of three large fund managers is not likely to diminish. The data underscores the overwhelming first-mover advantages these companies wield across diverse sectors. Astonishingly, they are both the masters and the pawns, as they hold each other's stocks in a fascinating reciprocal dance. Together, they constitute a vast network akin to a pyramid, with smaller investors subsumed by larger ones, perpetuating a cycle of ownership. At the pinnacle of this pyramid, we discern two entities whose names loom large: Vanguard and BlackRock. The extraordinary power vested in these two entities defies conventional imagination.

Would love to hear your thoughts in the comments.

Share this story and Join us in the chat!

If you enjoyed this story, share it with a friend and share your thoughts and questions in the Chat.

Copyright RAISINI 2023. Any illegal reproduction of this content will result in immediate legal action.

Some of the obvious questions for me are:

What's left of democratic processes and institutions in all this?

What are we doing when we cast our vote?

What about our civil liberties?

Those at the bottom of the pyramid are also a lot more numerous and the elites spend resources and device censorship regulations to keep the many under control.

Could this mean the many are not that powerless, after all, at least if they became aware of it and started putting up some resistance? Or is this wishful thinking?

My display crashed. Twice.

Reading this.